From what I gather the governments of Europe will make sure that pensioners wont get too rich.

you didn’t get it. They did have a retirement agreement with Switzerland. Only since they became a nation of it’s own they - for some reason still - don’t have one. The other bits of Ex-Yugoslavia that went independent do have one.

I seriously think it was the job of the Swiss to find a solution here!!!

So Brexit could have made all the difference.

Does Mexico have a retirement agreement with Switzerland? ![]()

I don’t believe Merz for a second. It’s all just show. After all, I believe the CSU just rammed through the “Mütterrente”, which was only possible because the defense budget was moved out of the “Schuldenbremse” and thus suddenly money was available.

Germany will finance its pensioners until nothing is left.

I wouldn’t worry about your pension, Slammer, more about the fate of your kids and grandkids.

See this:

It’s a tragedy. But of course, “nobody’s fault”.

Any politician that tries to change the course of things is voted out of office very fast.

I did understand. There was an agreement. Independence, no more agreement. Takes 10 years or so to get a new one. Since 01.09.2019 AVS money can flow again. AVS money was flowing to other countries because, they became independent like 15 years before. I assume they faced similar problems. Running a retirement office during a war may be a challenge.

No 1st pillar agreement between Mexico and CH. I’m in the very same situation as those guys. Retire in Switzerland or cash out. But, no crying. It is what it is.

My CH pension is locked in an account until I reach retirement age in the country I reside in. At least that was zthe promise, if it works as planned?

I dont know.

In the report it is said that there is no problem with the documents in the offices. And Switzerland was not in a war.

The other thing was with that man who is on IV: He was told everything would be fine, so he gave up everything in Switzerland and went home. Then it wasn’t. He was asked straight whether he had stayed in Switzerland had he known, his answer was a clear yes.

The Swiss just didn’t and don’t care. It’s a very black spot in our books. An other one.

The boss at the archive in Kosovo complains that other countries have more people working in his team and much less files to work with. For the guy in IV, he had a C permit. Return to CH, or cash out. Limited options, but not without options.

Maybe 9 years was a lot. The Swiss gov could have done things faster. But, independence is major unavoidable disruption.

It’s really unfair to tell the Swiss didn’t and don’t care. One important detail of the reportage is that it was made in a certain way to make the people in problems look in an unfavorable way. Why? Remember that no one is considered in “distress” around here as long as the person has assets. Not long ago there was news about refugees from Ukraine being denied assistance until they sold their cars. So, what was the most prominent thing showed in the video? Houses.

The very first advice from a Swiss that cares is to kick the youngs out, and rent the space to generate income. The young can work and make an income. Or, where have you seen an asset rich-income poor person renounce to potential income to host family?

You compare refugees to those people who came here year after year to do the worst jobs (building things the Swiss are proud of now), leaving their families behind, living under lousy circumstances here, supporting their families at home. Only thing they were able to do - cause cheap in Kosovo - was build a house. Where exactly do you think their families are supposed to live if they kick them out and rent the houses to … whom exactly?

Getting a C or B permit for them was only possible after 1991.

You should study the history of the Saisonnierstatut.

Modern type of slavery.

Well Switzerland does have a long history of slavery.

The country invested heavily in the trans atlantic slave trade and a lot of the oh-so-squeaky-clean financial houses earned their fortunes on the backs of slaves.

Nah

A type of Ponzi scheme

A Ponzi scheme is a fraudulent investment operation that pays high returns to earlier investors using money from later investors, rather than from any legitimate profits.

These schemes create the illusion of a successful business, but they rely entirely on a constant influx of new investors’ money to pay off earlier ones.

The scheme inevitably collapses when it can no longer attract new funds, leaving most investors with significant losses.

yes dear, exactly, that’s a Schneeballsystem.

My word. Just asked KI the question if the Rente is a Schneeballsystem…:

No, the German statutory pension insurance is not a pyramid scheme. Although it has elements that may be reminiscent of one, it is designed as a pay-as-you-go system based on the principle of mutual aid between generations, rather than the promise of quick profits, as is the case with a pyramid scheme.

Explanation:

A pyramid scheme is based on the principle that early participants are paid out through the contributions of later participants. It is not sustainable because at some point there will no longer be enough new participants to finance the payouts to the previous ones.

However, the statutory pension insurance works differently. It is a pay-as-you-go system in which the contributions of working people today are used to finance the pensions of today’s retirees. Therefore, today’s young people will finance tomorrow’s future retirees. This system is theoretically stable as long as the ratio of contributors to retirees is reasonably balanced.

However, there are challenges that strain the system:

Demographic change:

Increasing life expectancy and declining birth rates are leading to an imbalance, as fewer and fewer working people must support an increasing number of pensioners.

Financial burden:

The rising share of pensions in total government expenditure can lead to a greater financial burden, especially if contributions are not adjusted accordingly.

These challenges may require reform of the pension system to ensure its long-term sustainability. However, it is important to emphasize that statutory pension insurance is not a pyramid scheme, but a system based on the principle of mutual aid between generations and built on solidarity.

All good as long as enough people pay into the system.

Schneeball scheme is based on selling a product which may or not be successful.

A Ponzi scheme has no product.

Which is the situation we’ve almos reached now.

Which it no longer is. And, as someone already said, it didn’t come as a surprise.

the priciple of mutual aid is given with insurances like health care, accidents etc. etc. You pay yearly, if you don’t have a case it’s “lost” as it’s used on people who do have a case.

The pension they actually calculate how much you paid for how long and set the pension accordingly. They also “sell” it to you as a saving system.

LOL

Not necessarily. About 15 years ago a friend and his wife took part in a “Geschenkkreis”. A circle of people who would hand over presents - money. Of course they also had to acquire people for it. I guess that’s why he told me about it but I’m deaf of both ears on such subjects.

However, when it was one person’s/couple’s turn, the entire circle would all pay money (and we’re talking around 5K). Let’s say there were 10 givers that’s 50K, so he thought giving 5K was not too bad).

I have to ask him how that turned out, it was never mentioned again. ![]()

So, no product involved.

No product so Ponzi scheme.

Maybe you’ve noticed I used the German name only.

We have only one name for all your categories. Maybe German-speakers are just not as shifty as English-speakers ![]()

https://www.dict.cc/?s=Schneeballsystem

However, call it what you will. Everybody knows the basic idea we’re on about.

Well, forget about the rent advice. Anyway, it’s not a general case. Probably just an oddity in the reportage.

The Saisonnierstatut was widespread systemic abuse. The independence of Kosovo and subsequent issues with AVS was neither systemic nor widespread. It’s bad luck that it happened to the same people.

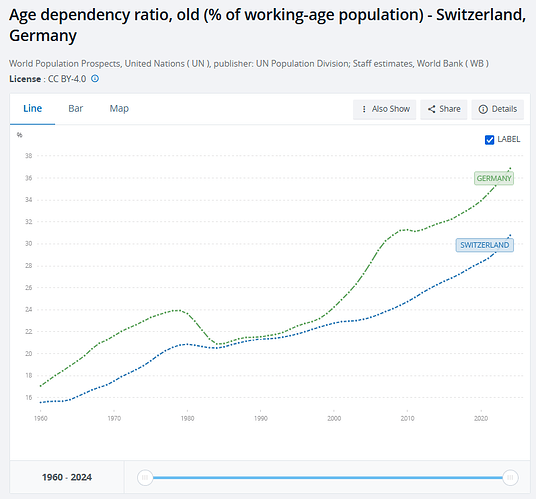

In not so good news, Switzerland is 10-15 years behind Germany in the trends of old age dependency ratio. Whatever happens in Germany should be taken a forecast around here. Anyone retiring by 2040-2045 in Switzerland should look at Germany and start questioning if the other side of the contract is able to fulfill the terms.

Probably not so bad because Switzerland has a robust system for bringing in working immigrants who will pay into the system in the future

that IS no good news. Aren’t we normally 25 years behind?

What’s the sudden rush?

One might ask what happened to the fund in reunification…