Usually the reciepts have summary by tax class

Yes, but there might be a difference in the VAT treatment of a certain good between Switzerland and the neighbouring country which will indeed make the life of the border guards a nightmare.

Luckily that’s their problem, I will do my dumb foreigner imitation.

Speaking of which I was walking last evening in Winterthur and a lady came out of a closed bakery with a sack of bread and told me to help myself.

Maybe time to update my wardrobe?

Around 50% of food in Switzerland is imported. Due to exchange rate food should be cheaper in CHF terms, but we never see this reflected in retail prices.

Haha, they do that because they don’t want to throw away the bread. It takes some effort to find visibly poor people here…so whoever is passing by…and maybe next time you’ll buy something from them. ![]()

Rather keep the same wardrobe, but change the itinerary to a steakhouse ![]()

But I thought post-covid sent food prices higher (together with Ukraine war). Maybe that more than offset any FX benefit?

Trouble is that it’s the tax in the purchasing country, not the Swiss class. So yeah, my French receipts list VAT code A at 5.5% and B at 20%, but only at the total level, so unless the definition is exactly the same as the Swiss one it’s not really going to help.

Back to the topic for a second, does anyone know if Parliament has, as well as making it less attractive to shop abroad, discussed ways of making it more attractive to shop here?

There are two ways of doing this and the way chosen seems a bit ‘East German 1960s’.

It’s because the prices have gone up in the countries it’s imported from. Compare inflation in those countries vs. exchange rates and you’ll see a remarkably similar curve.

Edit: I deleted a chart because it was not necessarily clear, but it was from this interesting article from the ECB about the phenomenon of exchange rate changes driving inflation, the flip side of what I was saying,

Is the echo it gets here really justified?

2.6% (food, pharmaceuticals) on the lower German prices is nothing. And if you don’t shop alone you can shift any surplus (preferably the low-rate foodstuffs) on a single person, and shift the high-rate stuff on the other(s) while of course keeping them under the limit. Assuming this is actually worth the bother.

ahhhh, that makes sense.

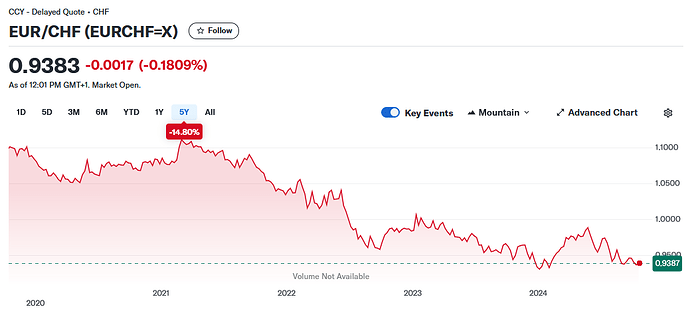

Countries around where food is produced have seen higher inflation, prices in EUR are higher but the evolution of EUR/CHF exchange rate more or less compensates for the inflation abroad. Thanks!

Another aspect to this is that the exchange rate change has largely eliminated the effect of inflation on my French supermarket shop. Yes, Euro shelf prices are higher, but once I convert to CHF the relative Swiss/French price differentials on various products have remained pretty much the same.

We still spend several months a year in France and even when in CH do most of our shopping over the border, not least because it’s a lot closer than driving all the way down the valley to the larger Swiss shops, the ones in the village here being just silly, price-wise.

Speaking personally, it won’t make a lot of difference. We (wife and I) live a 20 minute drive from the supermarket in Italy and rarely spend more than EUR 250 We also go twice a week as we like to buy fresh meat, fruit etc. The Italian supermarkets even refund the VAT and it’s a really simple and efficient process.

However, deducting the Italian VAT and then adding 8.1%, depending on the goods, still makes Italy a lot cheaper than Switzerland.

It’s a bit of a hassle though. I guess maybe if you can do it via the app, it is less painful than queuing at customs to pay or get a refund.

Hello and welcome back!

No, and unbelievably for Italy very easy. After paying you get the form from the customer service desk. At the frontier the Italian customs scan it and the amount is credited almost immediately to your account with the store which you can use on your next visit. We’ve never had to wait for more than a few minutes.

A few years ago I was shopping across the border from Basel in Germany and sometimes just didn’t bother to claim back the VAT to avoid the queue/hassle.

Does should have been mean it’s not combined?

Same here. During Corona I found suppliers at very good prices for the things I regularly got in Germany. And the few things I sometimes need/want that I simply can’t get here amazon now delivers to my doorstep free of delivery charge (nope I’m not a Prime customer or anything like it).

I never bothered to get the German VAT back. So it was new to me when I heard yesterday that people could claim it back yet not pay the Swiss VAT. If this is the case, 150.00 is still a generous solution.

Funny, it was you who added exactly this info to the op: