Money to transfer instantly instead of taking days:

Assume just during banking hours …

Opens the door for even faster fraud and scams.

Apparently 24/7

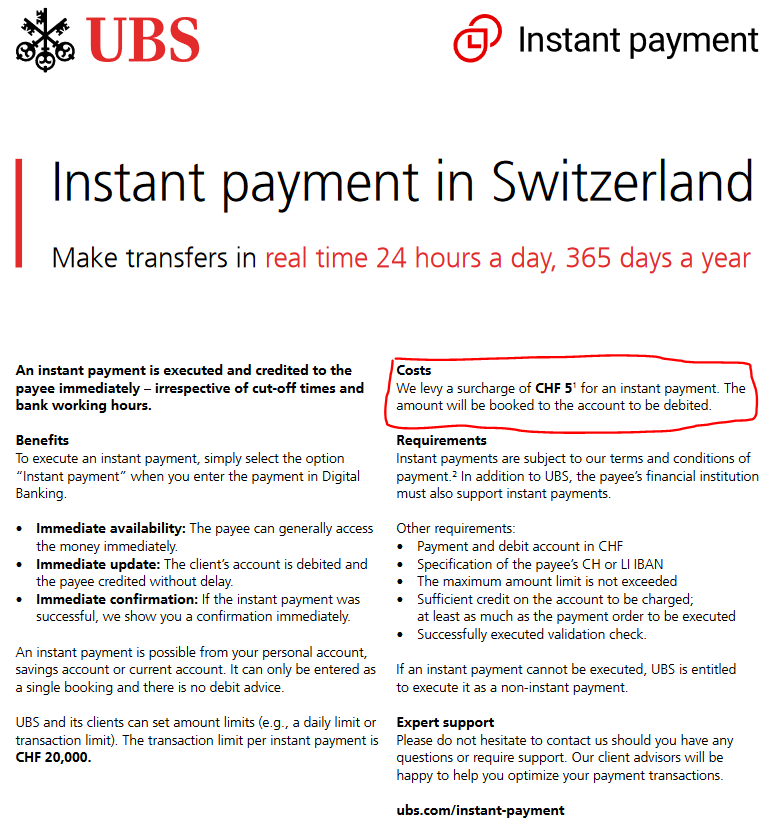

I went to make a payment this morning and this option was available at a cost of 5chf! The express payment option which used to be free is now 3chf.

Only the standard payment (ie next day) option is still free.

Are you banking with UBS?

I noticed UBS is among the worst banks in CH in terms of banking fees! Better to avoid!

Yes at UBS it’s 5 chuffs to be the proud sender of an instant payment

Quote from their app: “A surcharge of CHF 5 is applied to instant payments to UBS clients and clients of other banks within Switzerland.”

Frankly, at this cost I don’t see why would anyone use it other than truly exceptional situations

I couldn’t agree more. I’m sure most people are organised enough to make their payments in a timely manner and not need to use this option.

In Post Finance it’s also 5 CHF. Luckily I never needed to pay instantly.

Credit Suisse but it’s all the same now anyway.

This is impossible as Post Finance does not yet offer instant transfers (but can receive them). It is planned for late autumn. Instant payments is something just introduced.

“Same day payments” (express) have been around for a long time, but this is not instant. They do cost CHF 5 for PostFinance or UBS if done late (after 12:00 / 12:30 respectively) but free if done in the mornings. In UBS, it is still possible to do express, by not selecting instant payment, but instead changing the day to “today”.

Just noticed this after accessing UBS website. It’s a useful feature. At the same time, why? If I forget to pay something and schedule the payment to the next working day…things work. Never received a complain for a payment 1 week later.

So, what’s the use case of instant payments Switzerland and Lichtenstein? If it were instant SWIFT payments…that’s another story ![]()

Cash replacement that bypasses other alternatives like credit cards (costs!) and Twint.

(Twint itself is only superficially instanteneous. It’s actually delayed because it’s based on the old transfer mechanism, the receiving bank effectively acts as creditor until the money arrives).

With Raiffeisen, 12 IPs per year are free. Beyond that IPs cost 2 each.

That explains it. While reading this thread I was thinking that it was offered to me for free to me. But as I never used it, I wasn’t sure.

Trust the banks to ruin something by trying to profit even more at our expense.

I am not that organized and sometimes miss the deadlines because of weekends or holidays. I order the payments for next working day and no problems at all.

That is why I like e-bills. They come directly into your online banking tool, set to be paid at the last possible date, approve that and you are done.

yep.

And when they learn to send the warning about getting late a day BEFORE it will be perfect. ![]()

Yes I know if I checked those that need to be checked the first time I see them in ebill there would be no need for a warning. ![]()

I could see it as useful if you were buying a used car with a private sale and didn’t want to carry wads of banknotes in your back pocket which is normally the case.

You could look at the car and buy there and then with the seller getting the money immediately and you getting the car.

5 CHF would be trivial on a tens of thousands of francs one-off transaction.

The scammers will offer to reimburse the 5 francs. Be very very cautious if someone insists on instant payment.

I’d be much happier to have the option to put a mandatory 24h delay on all my payments.

Easy profit for the banks indeed. Is the 5 CHF still charged for an instant payment to another person who has an account with the same bank?