Hello folks,

Here’s a simple question for some of you. I am married, tax domicile in ZH and do not possess a Swiss passport. I am from the UK. Once the time comes, we will withdraw all proceeds from my Pillar 2 and move it to a “low cost” canton. We all know the good ones. My question is whether my wife and I would physically have to reside in such a canton or if we simply can open up an account there, wait x period of time, then move the cash, minus taxes paid back to our ebanking account. We intend to head back to the UK as our first stop. Thanks for your feedback.

I believe you have to be tax-resident there. If it was that easy everyone would do it.

Thanks. I may have erroneously thought that as a non-Swiss, it might not be necessary to take up physical domicile in such a canton. Looks like I will be checking out homegate then.

You don’t have to take up domicile in the Canton, however the pension could be taxed in your new country of residence. The Swiss tax is just a withholding tax, not necessarily a final tax

Also if the 2 pensions are of a different size, they might need to be in 2 different cantons, bear in mind moving the pension attracts costs & some providers are easier to deal with than others. Mine ended up with Picktet in Geneva & was very easy to cash out, so I was happy to pay extra tax rather than move to find problems later.

you dont have to move kantons. you can deregister and move to UK. Then you can open a 2nd pillar account in your kt of choice and ask that financial entity to transfer the funds from zrh to them. then you can ask the new FI to withdraw the money from 2nd pillar with proof that you have moved overseas (de-registration papers). They will withdraw the funds, send you the money minus the appropriate tax withholding and fees. Last i looked, fees associated with all this was about CHF 900.

best if you discuss first with FI in your kt of choice, specially given your permit.

To withdraw your funds, when you have reached pension age, you have to provide proof of where you are tax resident.

If you are tax resident somewhere in CH, you will receive the funds and afterwards a tax bill (withdrawl tax)

If you are tax resident abroad, you will receive the net funds after deduction of a “withholding tax” (different to a withdrawal tax). After you have dealt with the tax issues abroad and have proof of that I think you can then reclaim your “withholding tax”

Incorrect, I moved to an EU country & received my full Pillar 2 a few weeks after my 53rd Birthday.

The question is 'are you required to have compulsory insurance in your country of residence. I was not working or intending to work so did non need to be insured.

did you receive it in cash or transferred to another pension fund ?

If cash, was withholding tax applied ?

Cash with withholding tax, in many jurisdictions you will have to pay full local tax & then can obviously reclaim the withholding tax.

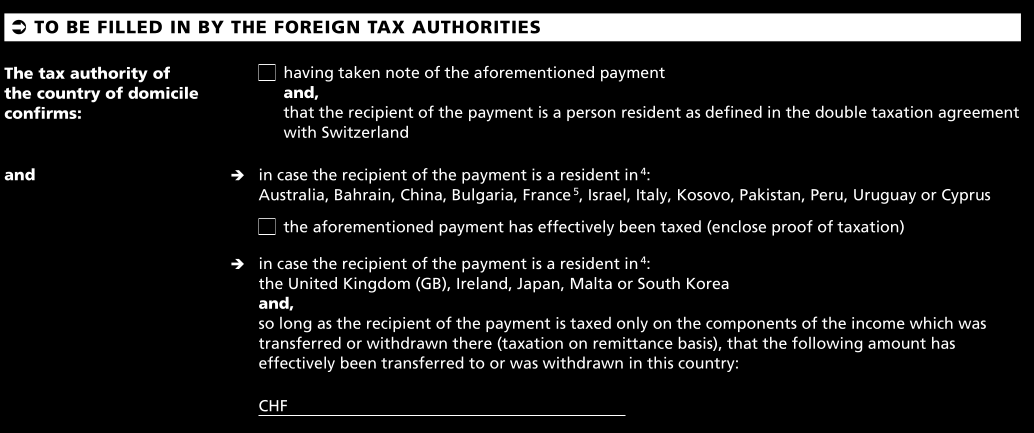

Depending on the double tax agreement, some countries will have full taxing rights to the withdrawn pension, so if you are resident there and paid withholding tax, you would be able to reclaim any WHT paid in Switzerland.

For anyone thinking of doing this, the issue is to understand the tax situation in the new country and compare that to a “withdrawal tax” while still tax resident in CH

Exactly, you have some terrible countries which can take half of your pension fund when you withdraw there. Then there are superstars like Singapore where it used to be possible (not sure if rules have changed since) to withdraw the pension tax-free and re-claim the Swiss withholding tax too.

The question was solely related to a move from CH to the UK. Given the CH UK agreement in place from 1977, I won’t be taxed again from HMRC, from what I have understood. We will leave CH for good and only return as tourists up to the maximum number of days permitted. We will provide UK proof of residence to my employer’s PK and that should be it. If we remain domiciled in ZH, I would assume that I would pay up to 10% max in tax on the entire pot, obviously more than I’d like of course. One post was interesting to understand more about. I still have a little time.

For the UK, you can see here:

slightly off topic here may be, but this ‘age-old’ tax reduction method of moving 2nd&3rd pillar accounts to cheaper tax kanton, before withdrawl … was this not discussed in CH around 2014 (or so) and agreed that all kantons would charge a fixed % across all kantons, effectively closing this loop-hole?

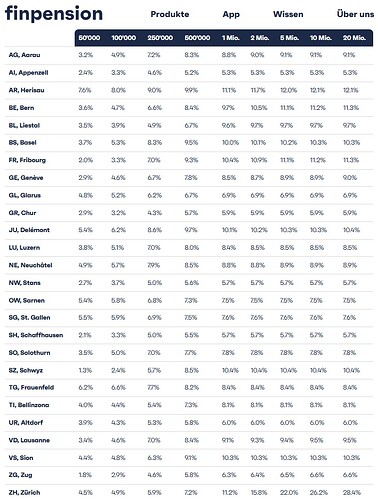

That may be true for Swiss residents, but for non residents, withholding tax varies by Canton, the Canton thats best for 100k may not be the best for 500k or 1M