All this discussion finally got me to get off my backside and register for a cheaper provider. I’m currently with Assura and just sent in the application to Swica.

I will save over 1’000 CHF a year and use my preferred doctor.

All this discussion finally got me to get off my backside and register for a cheaper provider. I’m currently with Assura and just sent in the application to Swica.

I will save over 1’000 CHF a year and use my preferred doctor.

You are saying Swica is cheaper than Assura for you??? Or have you changed your model also?

Yes, cheaper. As mentioned before, I have no doctor, so I had the the ‘standard’ model with Assura. Since, I’m using the drop-in center at Basel, and this doctor is on the list for Swica so could use the FAVORIT SANTE model for Swica which is over 1000 cheaper.

They go up 6 procent plus whatever else extra they want to add on!!!

Assura is cheaper than Swica in 2025- in Zurich anyhow. (300 franchise and accident cover)

From an equality and social justice perspective, it’s great.From an efficiency perspective, it’s a bit different.

Lowe income people pays VAT, fuel taxes, road taxes…and the list goes on. At the end of the day, we find out that people has no money left and tax money is used for subsidies. Maybe, it would be more efficient to tax less the low income people, lower the demand for subsidies.

Anyway, the world isn’t perfect. not the worst thing happening.

THey are a criminal mafia!

Another detail, inflation is low in Switzerland but it’s above zero.

Since I arrived to Switzerland, I’ve kept the deductible at the max of 2’500. I just checked the inflation calculator and 2’500 CHF from 2012 are 2’653 now. 6.2% difference.

Deductibles become cheaper over time and then we are surprised the primes go up. Just wondering what the prime price would be if deductibles were indexed to inflation.

Depends on what you index them to, inflation or health costs. Insurance premiums have risen by 4% annually since the introduction of KVG in 1994 on average, resulting in a tripling, whereas CPI has risen by some 20% only.

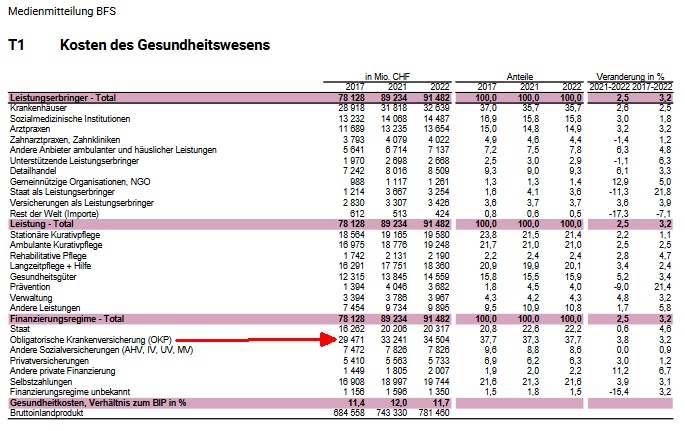

Keep in mind though that the premiums are only 37% of the entire health costs.

For reference: Health costs have increased from 36.5 bln to 93 bln.

Calculating back from today’s 2500 to 1994 you get either 2000 or 800. Calculating forward from 2012 that’s 4000 today, using the 4% average rather than actual data.

And that’s the new price for 2025?

How come you already know the swica prica for next year and me, a faithful swica member doesn’t? ![]()

You just have to look at the priminfo site, it lists all of them.

The insurers will slowly be sending out the letters to their customers over the next couple of weeks.

yeah, for that kind of money I want my personal information, on paper to frame nicely as in 2026 it will show me how nice actually were in 2025. The perspective then will be different from now.

I looked on the comparison website and then went to the Swica website, entered my details and got a PDF offer.

Love that someone posted that site for comparisons.

For my location (Zh) I noticed some “cheaper” ones like … Agricola or smth like that … and they only do German (something called SLKK) … while I am learning this wonderful language … I will probably just say FU and pick the cheapest provider that has at least some EN support (this year I saw Helsana would be for us) …

The rules for changing Lamal / KVG are in every insurer’s website.

Assura no longer requires payment upfront.

Many people I know, take insurance and use it like a subscription.

I’m paying anyway, might as well use it.

So every little service that insurance provides as an addition, they use to the full every year. New glasses, gym subscriptions, massage treatments, whatever it might be. some of my friends go as far as having these extra benefits as the deciding factor.

I hope the insurance companies offer them with the clear understanding that these will be used up, and they bake in a margin. Because it they offer this on an actuarial basis, on top of an ageing population that will statistically spend more and more on healthcare in aggregate, there is little surprise that every year insurance is getting more expensive.

Does anyone know the best way to vote on the health insurance referendum next month? I can’t figure out if the cantons contributing to all health costs will improve costs to the population or not ![]()

So every little service that insurance provides as an addition, they use to the full every year. New glasses, gym subscriptions, massage treatments, whatever it might be. some of my friends go as far as having these extra benefits as the deciding factor.

This is about the non-mandatory top-ups though. They’re profit-oriented, so the insured effectively finance their own abuse of them.

The rules for changing Lamal / KVG are in every insurer’s website.

- If the premium increases [the norm] you need 1 month notice (Nov 30), otherwise [unlikely] 3 months notice (Sept 30).

And how will you know 3 months (and the bit you need to get a new KK to prove to the old that you got one) before whether the premium increases? ![]() No need for a reason to change the basic KK yearly. And by end of Nov.

No need for a reason to change the basic KK yearly. And by end of Nov.

The rest seems correct