If your 27 years of additional experience really counts for nothing, then maybe it really is a disadvantage, but then in that case, it is arguably a deserved one!

It is not measurable, anyway in Migros a cashier does the same thing every year so it is just one year repeated 27 times. The today higher pension costs are measurable.

I was thinking the same, but didn’t speak loudly about it. The people who earn below the amount which triggers over mandatory contributions are most likely in professions/positions at the bottom of the salary pyramid. In that case, if the older are in disadvantage because of the higher % I’m all in to vote in increasing it (if not equalizing it with) for the younger. Having a % deduction no matter what, even if it exceeds the 2nd pillar insured portion, becoming the over-mandatory, is really bad, it serves only one purpose “pay as you go” for a badly performing 2ng pillar fund

I guess every 2nd pillar is doing bad when the social pyramid is reversing, having more old aged people than the actively working

Shop cashier was the first that came to my mind.

Bus driver is a good paying job and drivers are quite competent as soon as they finish their apprenticeship and get their first job. There is no reason for a 60 YO bus driver to be more expensive than a 30 YO one.

Less than 2 weeks to the referendum on the 2nd pillar of retirement. I was looking for news and I was pleasantly surprised by watson.ch. Most of times the website is basically gossip. This time there is a call to freedom:

This leads to the real problem: instead of flexibility, we should talk about arbitrariness. Ultimately, the insured are at the mercy of the employer and the pension fund. They have to “swallow” low conversion rates and high coordination deductions. Experience shows that it is difficult to fight against this in the boards of trustees, for example.

Unlike health insurance, you cannot freely choose your pension fund. You are “tied” to it. Freedom of choice sometimes appears in liberal simulations. Politically, it has no chance at all, not least because the approximately 1,400 pension funds can live perfectly well with the current system. And choosing the “right” fund would be challenging.

As a freelance in CH, employed for a single day to a week, I just got less as the Day rate included all of the employer / employee deductions.

I’m not sure how you can have pension freedom without ring-fencing individual amounts and scrapping risk-pooling.

Wouldn’t everybody try to flee those PF with large number of retirees? How would the PF pay the retirees? Can PF refuse members? So then they just acccept young people who contribute and refuse retirees that they have to figure out how to pay?

Yes, no one likes the 2nd pillar fund with larger fraction of retirees.

This is happening at my job right now. Some years ago, 2 companies (AGs) merged. Company 1 has a larger retiree/worker ratio than company 2. So, retirement fund of company 2 can pay more per year. Additionally, manager of company 2 fund has been able to yield 1-1.5% more over the last 10 years compared to manager of company 1 fund.

The outcome is that employees from company 2 (where I used to work) have fought against the merge of pension funds since several years ago. Fun thing is that we work for a new legal entity (new AG - company 3) but the 2nd pillar fund is an unsolved issue that leads to big discussions every year.

If I understood well, new hires are added to the fund of company . At some point there will be a parity in the retirees/workers ratio or payouts between the 2 funds of long-dead companies and the merge will be done. The point of my anecdote is that the problem of 2nd pillar funds with an unfavorable ratio of retirees/workers already exists.

Yes, it already exists, but is a non-problem insofar as people don’t get a choice.

Maybe it would be good to be given a choice as then PF will have to confront reality when they are left with only retirees and no contributors and have to pay a conversion rate that might lead to insolvency.

Interesting, can that actually happen?

I thought there was a government regulation about the percentage paid or is that just a minimum?

My Swiss company pension fund was in surplus some years ago and they just gave that back to the company.

I guess I could see it working like this:

You split between retired and non-retired and assets between are ring-fenced.

You accumulate into your own account choosing a PF which suits you.

On retirement you might change PF but then get paid according to conversion rate. It might be required to de-regulate conversion rates so each PF chooses their own.

Retirement payments are paid from your own account. If you die left over funds go into reserve. shortfalls can lead to reduced pension payment or be made up by PF from surplus funds.

PFs will compete on conversion rate vs prudence and reserves.

The minimum is met by both funds.

No law prevents any fund to pay with a conversion rate above the minimum.

My PF already lowered the conversion rate below the minimum. How that’s possible you may ask, as we did. There is a loophole in the current regulation allowing this. If your total payout from the mandatory and over-mandatory part, with whatever low conversion rate, is higher or equal to a payout of only mandatory portion at a standard conversion rate, it’s supposedly allowed. Sadly it means the PF can eat all over-mandatory contributions effectively, by lowering the conversion rate to the point that it will effectively evaporate. I’m shocked how bad the system already is!

Easy, easy…for the slow ones in the back.

If I understand well, there is mandatory conversion rate in %, and the pension fund is allowed to pay only the mandatory conversion rate in spite of extra contributions, right?

Anyway, there’s the right to get your money out of the fund. Rising the middle finger remains optional.

The mandatory conversion rate is currently 6.8% right? My PF lowered it to 5%, same as over-mandatory conversion rate.

Yeah, the future of the pension looks cloudy. Withdrawing all the money perhaps will be the only sensible option.

Oh, I missed these news during vacation. Someone found a calculation error on the 1st pillar fund forecast for year 2033.

Apparently, people feels deceived with the numbers portraying a challenging future to vote for pension system reform. Then, numbers better than expected, so…why change?

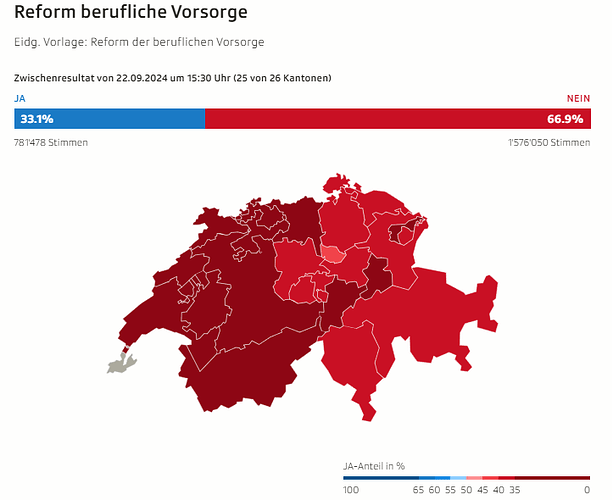

That’s a massacre ![]()

It seems voters chose to live out of social aid instead of pensions savings ![]()