Not sure if it’s worth opening a new thread.

Next 22.09.2024 there will be another popular vote/referendum about the retirement system. This time, it’s to decide on reforms on the 2nd pillar, a summary in French:;

The yes campaign have a website in DE, FR and IT https://oui-lpp.ch/

Something reasonable for once, the contributions to 2nd pillar for people above 55 years old are decreased so these workers don’t become unnecessarily expensive.

I ran the numbers with my age and salary and they look nice. The decrease in coordination deduction yields a larger insured salary, but the the decrease of 10 to 9% contribution compensates it. So, the overall increase to 2nd pillar contributions would be less ~1.5%.

Young people (25-34 YO) which currently contribute with 7% to 2nd pillar will not be happy. I ran the numbers with my salary and the increase of insured salary and contributions from 7 to 9% and it yields a ~45% increase in payments to 2nd pillar compared to today.

So, the proposed reform can be summarized to reducing the difference in contributions to 2nd pillar depending on age. This is nice, right?

Additionally, the decrease of minimum salary for 2nd pillar to 20k CHF and the decrease in the deduction coordination from 25k CHF to 20% of raw salary would bring more workers into contributing to 2nd pillar. Also nice.

EDIT: fixed a mistake in last paragraph about minimum salary for 2nd pillar.

1 Like

I think it is a good step to reduce the difference in contribution. Maybe it makes sense to flatten it and have a fixed absolute contribution for a certain level to help lower paid workers. Why not just have 14% for everybody?

As we all know, compounding helps, so earlier contributions should mean bigger pensions in the end.

I split the topic, as I think it is good to have the referendum as a separately searchable topic and then more relevant instead of getting lost in the long AHV topic.

1 Like

Haven’t studied this yet. My gut response is that you quote a pro-site that makes it sound all nice and dandy. I am a bit skeptical when it claims “win-win-win”, but I might be wrong.

Would there be any change to the mechanism of getting a one-off capital payment instead of the annual rent?

The NO side, switch to German in the top right:

Then there’s a rant about increasing contributions during working life that yield to higher savings but lower annual payments in retirement. Maybe I’m wrong but I just look at the monthly deductions and the saved capital, couldn’t care less about the annual payment in retirement. I’ll take my money in one payment.

Then, there’s a valid complaint about admin costs of 2nd pillar institutions, but no idea how this relates to the topics being voted.

Another complaint about inflation, but 13 AHV payment solved that. Supporters even celebrated the win. So, time to shut up.

Finally, another complaint about people already retired in poverty. This is asking a potential reform of 2nd pillar system in the future to fix the past. Very reasonable.

PS. if they really don’t want the finance industry to profit from 2nd pillar…let’s abolish the 2nd pillar and we get all our money today, every month

Unfortunately, you have to force people to save as otherwise, they’ll just spend everything today and more and then you’ll have to bail them out in retirement.

3 Likes

Indeed, so we don’t bet it in real estate or equities in a degenerate way

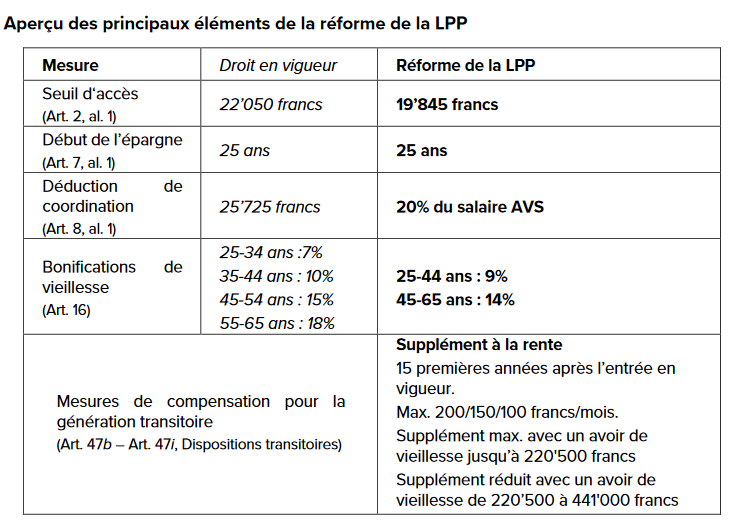

I tried to find details of what will be decided and saw this:

- Reduction of the minimum conversion rate to 6%.

- Compensation for the transitional generation: A supplement payment for the first 15 transitional cohorts is planned if the reform is approved. This payment serves to compensate for the reduced conversion rate.

- Flexible coordination deduction: The coordination deduction was a fixed amount up until now. New plans include compulsory enrollment of employees into a pension fund starting from an annual gross salary of CHF 19,845 and having 80% of their salaries insured at all times.

- Adjustment of retirement credits: The aim is to better align the difference in contributions across various age groups.

Currently, the minimum conversion rate is 6.8%. A long discussion about it here:

First time I look at these numbers. I need to save around 2 million francs in 2nd pillar to keep my current income with the minimum conversion rate  So, I’m no retiring in Switzerland, go live to a cheaper place.

So, I’m no retiring in Switzerland, go live to a cheaper place.

I guess 6% is not a bad deal!

The 6% however is only on the obligatory part and on the additional it can be whatever your plan sets - many companies are moving to a split plan where the extra mandatory part is only capital at retirement.

Did we not have same % for contributions across all age groups not so long ago and was changed?

Check your actual pension fund. For the “over-obligatory” part, mine is at 5.1% now.

It was a rough calculation. Yes, the “conversion rate” or yield is lower for the non-obligatory part. That means even more savings.

Back to the vote, the proposal is not bad. It removes the issue of workers 50+YO made artificially more expensive than younger ones.

If the proposal narrows that gap, that is a generally good thing. Especially for old fucks like us.

3 Likes

I’m fit into the old fuck category, so I’ll be voting for it.

I think it only helps at the margins since older people generally have higher wages anyway. I would support that they just bumped up everybody’s contribution to the same highest level.

It would allow older people to compete with younger employees on same labour cost by removing an otherwise insurmountable disadvantage.

1 Like

Like I said, typically older workers have a much higher salary which dwarfs the impact of the pension costs. It is hardly insurmountable, though: employers just need to decrease the wages so that the total cost of the employees is the same.

But like I said, I’d prefer it flat or even higher for younger people so that the contributions have longer to compound.

When you go up for a management position, yes. But, lots of people keep the same job. A 23 YO cashier at Migros is cheaper than a 50 YO cashier at the same Migros…BY LAW

3 Likes

I don’t see much sense in the manipulation of the coefficients. The coefficient should apply with ceiling over the mandatory portion. Any employer should remain free to offer to top-up any amount of over-mandatory, but it shouldn’t be required because of the x% of the salary makes over mandatory contributions.