So it looks like if you own a property in Switzerland and a property in the UK, it is likely that you may end up paying double council tax from 2025.

I realise that this is reserved for a minority of people. Still sucks though, after paying a hugely inflated stamp duty as well.

Too late, we’re already paying 3 times as much this year on ours. 300% on top of the base figure.

1 Like

Isn’t the 300% only for properties which are empty and unfurnished for a long time, or for houses in Wales?

Yep, which is what ours has been. Went up from 50% to 100% last year and now 300% this year. Ours is furnished as we use it as our base when we go back to the UK.

So your house is in Wales? I’m no expert but I thought that only Wales was charging up to 300%?

If you use it when you are back, then it is not considered empty. I believe the definition of empty is unused for more than six months.

I think it’s considered empty if it is unused for more than six months of the year regardless of whether it is furnished or not.

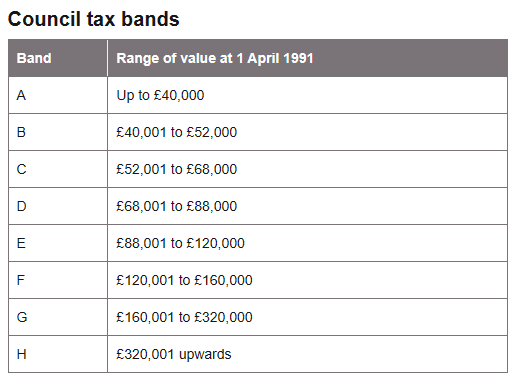

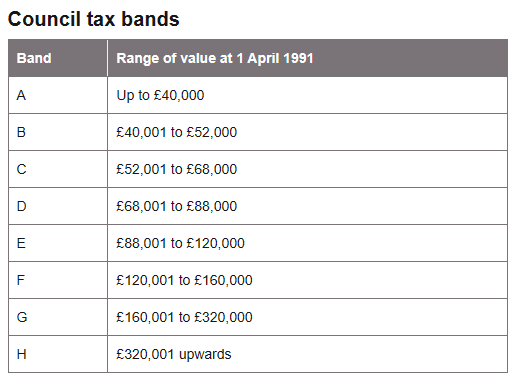

Nope, England. Mind you with many councils going bankrupt/on the verge of bankruptcy I suspect it’s time they updated this.  Bears no relation to current house prices in our area.

Bears no relation to current house prices in our area.

" Council tax valuations are based on the value of domestic properties on 1 April 1991 . The value is the price the property would have sold for on the open market."

Back in 2012 there was no extra charge for a property being empty, just looked at our previous council tax bills.

Well, the council tax band ultimate has little to do with the double or triple premium for empty or second/holiday homes.

To be honest, I’m not really sure I understand your situation.

As I understood it, only Wales currently has up to 300% council tax for second / holiday homes.

England only has the option to increase it to 200% from 2025.

In the UK only homes which are considered empty for a long time can currently attract >200%

Since you say that your home is in England and that you use it when you go back, that you are paying 300% doesn’t really add up. Can you elaborate?

Not much. The house is effectively empty since we inherited it in 2011 as we’ve been here since 1998. How/why it’s 300% this year I can only put down to our council being bankrupt and they maybe have special dispensation to increase it.  Couldn’t find anything on their website this morning about long term empty property when I looked so no idea why it’s that much this time around.

Couldn’t find anything on their website this morning about long term empty property when I looked so no idea why it’s that much this time around.

1 Like

Other thing I find hilarious about all the empty property stuff is those properties aren’t using most council services yet get taxed the most. I get that councils want properties to be occupied, but that’s a personal decision by the owners for various reasons. We did think about renting the property out initially, but having done that with our previous house before we sold it we decided we didn’t want to deal with that again long distance.

1 Like

Maybe they treat it as empty and you should tell them that you are there at certain times within every six months, and that they have charged you incorrectly.

Anyway, heard back from the council yesterday evening and yes, once we’re back permanently and let them know then the rate will be adjusted.

Nobody in the house means nobody there earning and paying taxes, and spending in the local economy which has a multiplier effect. If you were to tax empty houses for the full economic impact, I expect it would be much more than 3x the council tax.