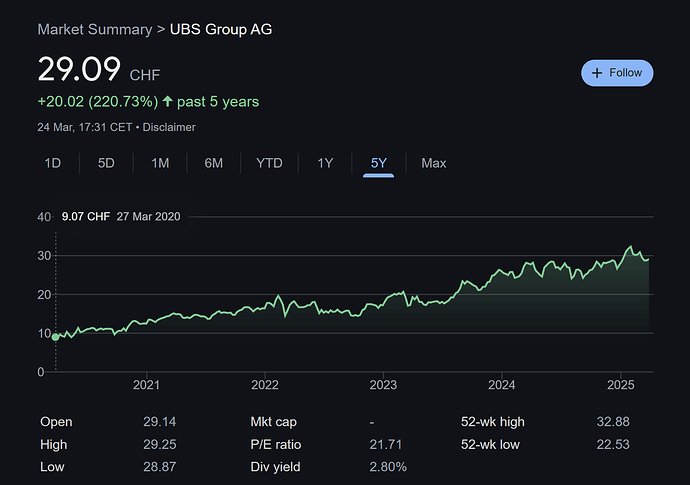

Truth is UBS is backed by the Swiss government. Which government will back Revolut if they go bankrupt? Short-term gains to save a couple of bucks on FX by using cheap providers will one day hit a person back in one way or the other.

As of today, the exchange rate:

Revolut: 1000 CHF = 1131.56 USD

UBS with 0.5%: 1000 CHF = 1137.32 USD

Difference: 5.76 USD

Although that can only buy you probably a piece of bread or a coffee in Switzerland, given the financial security is far greater.

UBS data breach in 2023 was within America in their WM America’s business with no financial loss. Searching for Revolut, it has far greater fraud cases, one in 2022, other in 2023, the other in 2024, in total more than $20 million lost, more than 50k customer data breach.

Revolut charges 10 USD/month for their premium and more for their even better service, so one way or the other they are probably overcharging more for their services than actual banks.

Hidden charges are also common with such companies, and if somebody is a victim of fraud with such virtual banks getting their funds back is nearly impossible.

Plus they explicitly state they open a CH IBAN account for you somewhere in Lithuania, that already seems as a red flag. Masking an account present in Lithuania as a Swiss bank account, doesn’t that sound shady? People just want to save a few bucks regardless of the future consequences.

Plus the only way to contact them for support is via chat, how nice. Who wouldn’t want that to be the only communication channel.

https://help.revolut.com/en-CH/help/transfers/inbound-transfers/how-to-receive-money-from-another-bank/what-account-details-should-i-use-to-transfer-money-to-my-revolut-account/help-with-swiss-iban/

“Please remember, cheaper does not always mean the most secure.”