Revolut customers say e-money firm failed them after being scammed - BBC News

In February, Jack was in a co-working space when he received a phone call from a scammer pretending to be from Revolut. He was told he was being called because his account might have been compromised through being on shared Wi-Fi.

If I have an issue with Revolut, I use the in-app chat. And there are a lot of warnings that banks do not call you?

Story relates after client falls for a scam and wants his money back. I don’t believe Revolut’s security is lacking, just their empathy.

He sounds incredibly naive, if I received a call from any bank it would be me asking the questions e.g. tell me what my last 3 transactions were, DOB, address etc…

In any case I use both Revolut and Wise and never have more than a few grand in either. It’s just used for overseas ATM withdrawals and day to day spending.

While I feel bad for him, he did literally authorize these transactions. And since it was a business account, then I assume, they need to allow big and regular transactions to go through - as compared to a consumer account where you normally get some checks. He had a 6 figure sum in there, so should have managed this with the appropriate level of security.

" He believes criminals managed to bypass facial-recognition software to gain access to his account on their device. If an account is set up on a new device, Revolut asks for a selfie, which Jack says he did not provide.

Jack says he asked Revolut to show him the image used to authorised the new device. They eventually told him that it wasn’t stored in their system, so there was no way of proving what the fraudsters had done, or what photo was used.

Panorama investigated this apparent vulnerability and found that it appeared to have been fixed."

Well, as said before, the first mistake the lad made was holding 165k cash onto Revolut.

Then the fact that 165k were transferred in such a short time should have triggered AML checks and all kinds of alarms. That may be on Revolut - but then again, there’s probably more to the story… How did the scammers knew he had so much cash to target him with such a sophisticated scam?

He says criminals managed to bypass the ID verification process to gain access to his account.

But also

Jack was tricked into handing over enough information to allow the scammers to put his Revolut account onto their device.

So which is it?

I assume they ‘bypassed’ it by using information provided by him and/or gathered from online sources.

Last time I installed the app on another phone, I had to take several selfies before it gave me access.

Could it be done by a picture off the internet maybe??

I don’t think this was an inside job as but as they simply hit the account with 65 small transactions. What should UK customers use instead of revolut? Many UK residents have been driven towards Revolut and Wise due to problems opening new Euro accounts with many high street banks in the UK not offering them unless you are a Private Banking customer. Do any of you know of high street banks in the UK that offer Euro accounts to non High Net Worth individuals (asking for a friend)?

Revolut and Wise are not banks, and could simply fold up like any web based enterprise, taking all their deposits. Maybe don’t sounds like good advice.

Most banks will offer you such an account. This was a business account. He could just go to HSBC. They might not be the cheapest, but cheaper than non-refunded fraud.

Revolut has a banking licence.

“The e-money firm - which has not yet been granted full status as a bank - says it takes fraud incredibly seriously and that it has “robust controls” to meet its legal and regulatory obligations.”

It’s on BBC right now. It’s apparently got a temporary licence at the mo with a provision to get fully licensed whereupon it will be fully fledged and authorized to provide a full service including mortgages, credit cards, etc.

Interesting programme so far - scary company.

Ohhhh, most banks. Well, this is not an old boring bank, this is a cool new bank. Not like most of them, it’s exciting!

Jack also believes the fact that 137 individual payments were being made to three new payees in the space of an hour, should have raised concerns with Revolut.

Most banks and financial institutions monitor customers’ accounts for unusual activity.

Revolut has had a Lithuanian banking license for several years, the UK license was not approved until Summer of 2024.

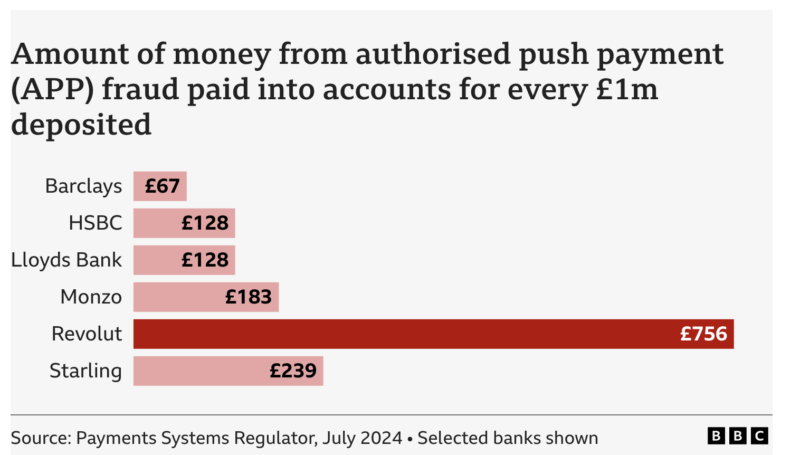

While revolut’s security may not be directly lacking - they have a much higher fraud rate than other banks.

Of course, so we users have to be extra vigilant.

So Revolut seems to now give you an individual Swiss IBAN via a bank in Lithuania?

Anyone know what this changes and if there are any new features from this?