- 3000

- 3500

- 4000

- 5000

- 10000

- 42069

I assume a small depreciation in USD each year to get to $3000-$3500.

SMALL? You might want to rethink that.

Does it matter?

20 views, 3 votes …

To some, perhaps.

I clicked on 42069 because I was physically unable to resist ![]()

Prices can go ridiculously high because gold is not only held by central banks or investment funds. It’s also owned by millions of people around the world. Any spike in price will attract even more buyers. Anyway, the people that buys gold does not need liquidity to survive, so this bubble can grow and grow.

Just for fun, I’ll buy 100 francs in gold via e-banking. Let’s see what happens. Not sure if the price will go higher than 6k USD, but I’m sure I’ll sell at that price.

Gold prices went up massively already last year:

And also increased a lot after US froze Russian USD assets, leading some organisations to diversify away from USD counterparty risk and invest in gold instead.

Increasing US debts/deficit is also a factor adding to those looking for some kind of safe-haven.

We’ll see if the bump in prices start to bring in retail investors looking for something to FOMO into…

![]()

And then the price is up there and for some reason you are desperate and - there is nobody who wants to buy it.

With the banks not wanting to give me my money back (well, only in tiny little lumps per quarter year) because they think being told to up their equity can be done by blocking client’s money, I’m thinking of buying a mattress or two. Ikea should do, no?

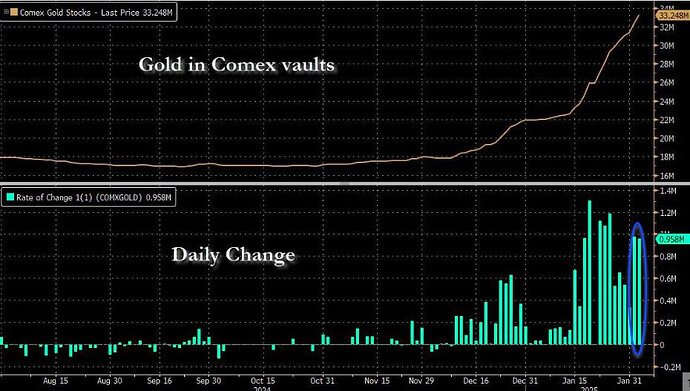

There are signs/rumors that the the US is repatriating their gold. LBMA is apparently dry and has a waiting list of eight weeks for delivery.

That’s not how you bring down the price of gold.

These spikes create self-feeding frenzies because buyers of paper gold with delivery options suddenly start to exercise those, because when the music stops, the paper will be worthless….

Also, my personal conspiracy theory is that DOGE will make a field trip to Kentucky and do an audit…

A lot of gold was shipped to the US as people feared tariffs on gold.

I read that it could also be Basel III related (as if US implements later this year, gold would be classed as a Tier 1 asset).

Anyway, I find it concerning and wonder whether I should switch my gold investments to ones that are physically held in Switzerland instead to guard against a scenario where it might be difficult to ‘repatriate’ or convert gold.

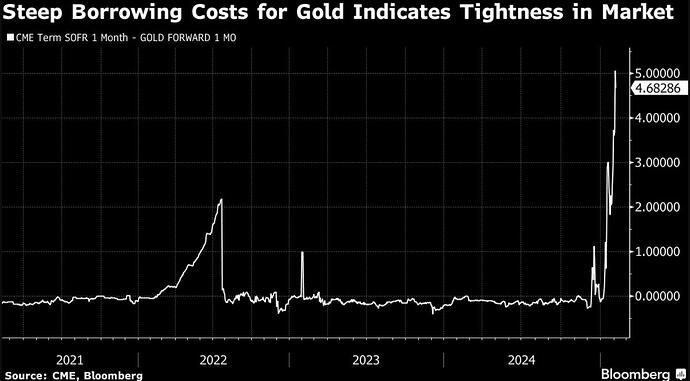

Gold lease rates have also spiked so I wonder if this is a sign of tightness in the physical market. Maybe the gold price has a lot further to run…

I found this few years old article: Basel III and the Gold Market | World Gold Council

Allocated vs. Unallocated Gold

There has been much speculation about the impact of Basel III (including the NSFR) on the allocated and unallocated gold markets. Some commentators have noted that allocated gold can be considered a tier 1 asset and therefore receives a risk weighting of zero. This is nothing new. Gold held in own vaults or on an allocated basis has always been a tier 1 asset under the Basel Accords. This is because allocated gold attracts no credit risk – it is neither the asset or liability of the custodian bullion bank and is therefore not considered part of the custodian bank’s balance sheet.

So, whilst the Basel III Tier 1 capital rules do not materially change the treatment of allocated gold vs. unallocated gold, the NSFR will impact on-balance sheet gold. But does this mean the unallocated gold market in particular will disappear as some commentators are suggesting? No it won’t, but the costs of holding gold on balance sheet (regardless of whether it is allocated or not) will go up. Unallocated gold is an essential source of market liquidity. The clearing and settlement regime depends on it, and without an unallocated gold market it will be very difficult to finance (and facilitate) the upstream activities of gold producers and refiners, and the downstream users of gold such as jewellers and fabricators. The real economy demand for gold relies on the unallocated gold market. So whilst funding costs will increase, we are unlikely to see a major distortion in favour of allocated metal due to the imposition of the NSFR.

Silver lease rates have also rocketed. I wonder if this indicates that silver prices will eventually follow.

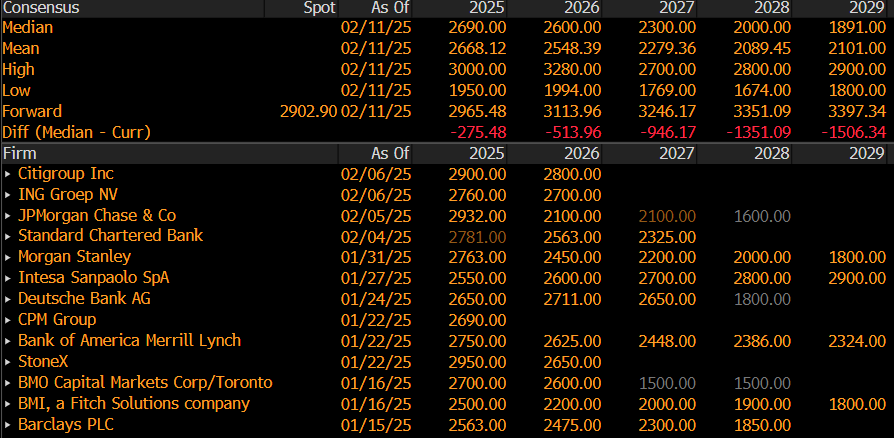

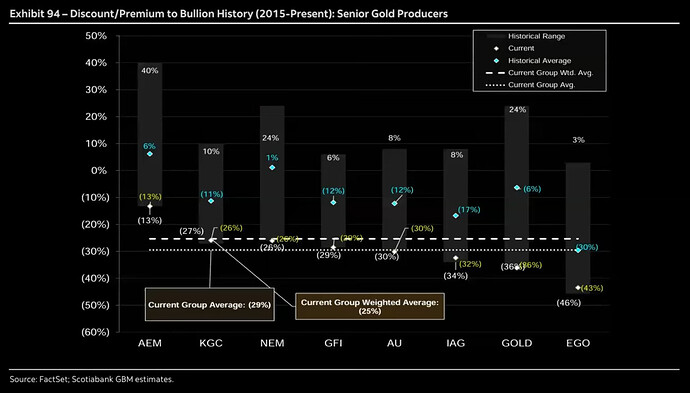

Market is tight now on gold for sure, but sell-side is pretty unanimously bearish a couple of years out.

Median Bloomberg collected forecast is about 300 USD below current prices for 2025, and then gets ugly further down the road:

Personally I don’t get the fixation on gold. I don’t really subscribe to the safe haven argument (if it hits the fan, everything could be worthless) and if I’m going to speculate, I’d rather have free drinks at the casino. ![]()

You had me excited there for a second, thinking I could buy future gold at $2000 or less. But when I looked, the price was only going up: https://www.cmegroup.com/markets/metals/precious/gold.quotes.html

In fact, the future 2029 price is the same as what I had guessed for the original poll above!

I never looked at Gold futures before. Certainly not when I made the poll.

I bought my gold on Valentine’s Day 2020 at almost exactly 50000 CHF/kg, which was the weekend before Apple cut their outlook due to COVID in China being in full swing.

After that, COVID hit mainstream media.

At the time, the clerk at ZKB implied that it might come down soon because it had risen quite a bit before that.

Of course, other investment vehicles would have performed even better.

Those futures are - I assume - for paper gold?

I’ve read a claim that the Biden administration sort-of propped up the economy by importing all those illegal immigrants and subsequently funneling money to them via various NGOs, the end-result being that the US is more or less already in a recession (and not getting out of it any time soon).

The gold-price always is and always was also a hedge against USD devaluation. I can’t imagine a recession in the US having a positive effect on the USD (or on anything other than the Gold price, THB).

In “The Big Short”, the guy tasked by the Brownfield Capital guys with selling their shorts (Ben Ricker) tells them that every decimal point of unemployment increase also increases deaths: in a recession, more people die.

The “divine heaviness” of gold is a faint reminder of the fact that its increase in value comes at a cost, too.

That’s like trees taken down by the wind during a storm. The wind did the final push, but the mushrooms and/or insects eating away the tree trunk did their part uninterrupted for several years. So, can you really put the onus on the wind? Enjoy the appreciation guilt-free.

I hope the Swiss Franc can handle this storm (manipulated by SNB) without appreciating too much. Just look at world bank data on how much the Swiss economy depends on exports. If the Franc goes up, people around the world buy less Swiss thingies and services, not good.

Those are physically settled with a 100 oz contract size, so you better know what you’re doing before you buy! There are also some financially settled futures with smaller contract sizes.

Heard recently that we are now in the golden age.