Hi All

I’m a UK citizen who has just finished a 15 year stint living & working in Switzerland, and will be taking early retirement to go and live in an EU country, where, as part of my application for residency, I was obligated to take out private health insurance (at a fraction of the cost of Swiss insurance).

I had a interesting exchange with my Swiss health insurer when I informed them that I wanted to cancel my insurance as I was leaving Switzerland permanently to relocate to an EU country. They asked me to complete a questionnaire which includes a question ‘‘will you retain a financial connection with Switzerland when you leave’’? I asked the health insurer how should I answer this question since when I leave I will cash in my 3a and non-mandatory pillar 2 pensions, but otherwise will not retain any ‘‘financial connection’’ with Switzerland, i.e. no bank accounts or investments with the exception of eventually claiming my pillar 1 and the balance of my pillar 2 pension in several years once I reach the appropriate age.

Their response was that ‘‘a lump-sum withdrawal also triggers the obligation to take out insurance in Switzerland, so that you must (continue to) take out insurance in Switzerland’’, but that I should check with the KVG.

(The KVG is the body set up by the Swiss government as the ‘‘health insurance liaison body for recipients of a Swiss pension resident in an EU/EFTA/UK and insured in Switzerland’’ - interestingly they are funded by the Swiss health insurance industry…)

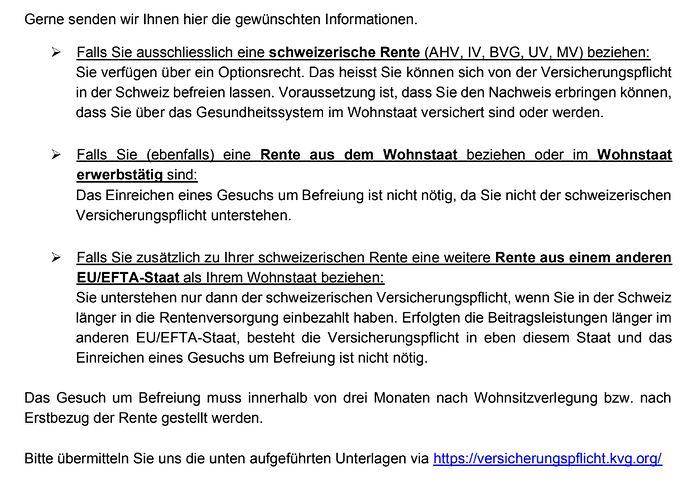

I contacted the KVG, explaining my situation, who replied ‘‘As soon as you have received your Swiss pension, you are subject to compulsory insurance in Switzerland. An early withdrawal/capital withdrawal or a payment from the 2nd pillar also leads to compulsory insurance. Private insurance does not release you from the insurance obligation in Switzerland. As soon as you draw your pension, you have three months to apply for exemption from compulsory insurance. If you do not submit this application within three months, it will be rejected and you will be obliged to take out insurance in Switzerland.’’

I was very surprised at this reply because this practically means that anyone who has ever worked in Switzerland and who claims a private and/or Swiss state pension triggers a requirement to retain Swiss health insurance.

Having looked at the guidance it seems that if you move to some, but not all, EU-EFTA-UK countries, then you can apply for exemption, but that the KVG is the decision maker (note previous comment about them being funded by the Swiss health insurance industry).

I have been going back & forth with the KVG to try & get clarity but getting nowhere, & they continue to insist that I have to apply for exemption & they decide whether to grant it or not.

I was wondering if anyone has come across this before and how they have dealt with it (how is it even enforceable if they decide not to grant exemption?)

Here is a link to the Swiss Federal Office of Public Health guidance: