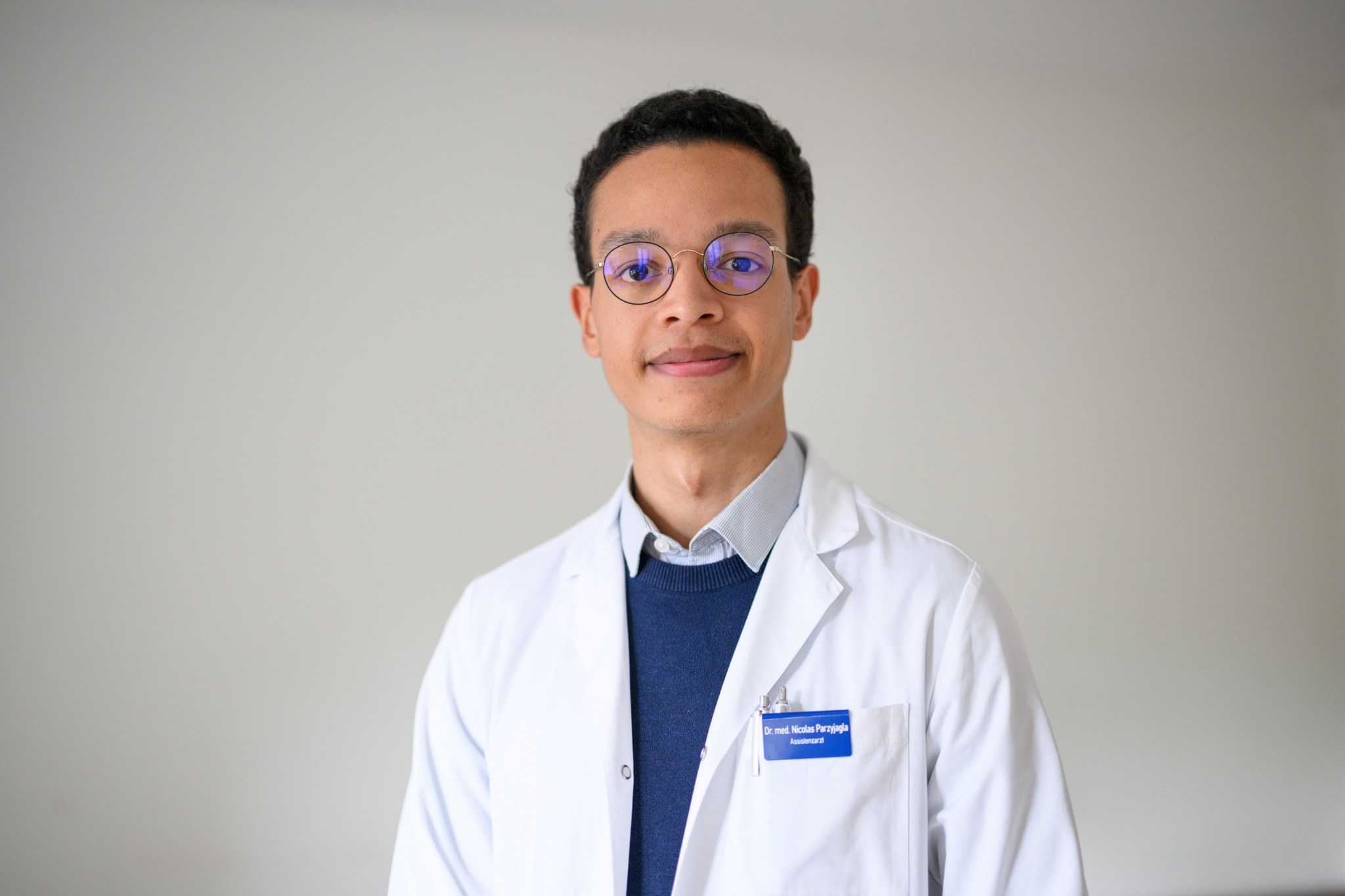

A few months ago, I met a doctor called Nicolas. Today, I saw there was an article about him in the newspaper:

Assistant doctor today, retired tomorrow

He wants to retire at the age of 30 – and is saving radically to achieve this

Nicolas Parzy-Jagla doesn’t care about restaurants or expensive vacations. This is supposed to enable him to retire early. But can it really work? The 29-year-old gives us a glimpse into his budget.

A working life in fast forward: Nicolas Parzy-Jagla wants to retire after eight years as a doctor.

Photo: Dominik Plüss

Shortly :

- A 29-year-old intern is planning his early retirement at 30 by minimizing his consumption.

- By investing in real estate and funds, he will generate 3,000 francs in monthly passive income.

- Financial experts warn of the risks of early retirement without the option to return.

Ten people are sitting together at the Tramdepot restaurant in Bern: nine men and one woman. Only some of the group order beer, fries, and tarte flambée. Others, as one young man puts it, “avoid commercial consumption” and order nothing.

Instead of spending their money, they talk in English about how to grow it as efficiently as possible. With equity funds, cryptocurrencies. Or would it be better to invest in real estate? “I’d have to deal with the tenants, which isn’t for me,” says the owner of an IT company.

The group meets several times a year at their local pub. The theme is the same every evening: the dream of Fire. The acronym stands for “Financial Independence, Retire Early.”

The goal: to retire at 30, 40, or 50. The plan: to work for one or two decades, earn as much as possible, invest as much as possible, reduce expenses to a minimum, and then retire.

The group at the Bern tram depot exchanges ideas about investment strategies and a frugal lifestyle. But every now and then, they also indulge in a little luxury, like a tarte flambée.

Photo: Raphael Moser

The goal is to make ends meet for decades with so-called passive income. Instead of a salary, daily living expenses are covered by interest from investments. Many Fire followers maintain a frugal lifestyle before and after early retirement, managing their finances accordingly.

The movement began in Canada, where software engineer and blogger Peter Adeney, aka Mr. Money Mustache, made it popular in 2011. Fire followers now exchange ideas worldwide in online forums. Or they meet in person, like the group in Bern. Not everyone wants to retire significantly early—some are simply interested in investment strategies. For others, Fire is more of an ideal, yet unattainable for them.

Nicolas Parzy-Jagla, on the other hand, is already very close to his goal. He initiated the meetings at the tram depot a good three years ago. The 29-year-old intern has since moved from Bern to Basel.

No gym membership, no expensive restaurants

Here, near the University Hospital, he lives in a 30-square-meter shared apartment. A table, a bed, a sofa, and a television he bought from a colleague for 200 Swiss francs. Everything is inexpensive, everything saves space. “I don’t need much,” he says. His appearance is also unfussy: round glasses and simple clothing.

“People buy things just to impress others; I don’t want that kind of life.” So he doesn’t have a gym membership—jogging is free. He doesn’t go on expensive vacations—his last trip to Genoa with Flixbus and a rental apartment cost 400 Swiss francs. He doesn’t go to fancy restaurants—he can eat for free in the hospital cafeteria during his shift.

Nicolas Parzy-Jagla lives in a small space and with cheap furniture.

Photo: Dominik Plüss

As a junior doctor, Parzy-Jagla earns CHF 7,500 net per month. He invests CHF 6,000, a smaller portion in exchange-traded index funds and a larger portion in apartments. He now owns seven apartments in Mulhouse, France.

In the border town where he grew up, “the best of both worlds come together,” as he says. Real estate prices are affordable; he invested around €100,000 per apartment. And the numerous cross-border commuters are willing to pay higher rents.

He plans to retire from working life in just one year. He’ll be just 30 by then. He wants to pay off his last two apartments by then. He’ll have 900,000 francs set aside. This will allow him to pay himself a passive income of 3,000 francs per month.

Matura at 14 years

Even in his school career, the French-born man took bigger steps than others. His parents homeschooled him, allowing him to skip several grades, and he graduated from high school at just 14. He studied medicine at an international university in Romania and came to Switzerland as a junior doctor seven years ago. “That’s when the harsh reality caught up with me.”

The working hours are “extremely long.” At peak times, he says, 70-hour weeks are sometimes on the agenda. And: “You spend more time on the computer than with the patients.” All the pressure has made him numb.

Now he’s opting for Plan B: retiring after eight years. Is that responsible in times when there’s a shortage of doctors everywhere? Of course, he sometimes feels guilty. “But I don’t want to pay for the failure of politicians.” More doctors need to be trained, and better working conditions are needed to keep people in the profession, he believes.

From 100 to zero, then, and yet Parzy-Jagla isn’t afraid of falling into a hole. “I won’t be a typical retiree,” he says with a laugh. He still has so much planned. Understanding the universe better, perhaps taking astronomy courses, making a film, learning Japanese.

The most important thing in life is time, he says. “I don’t want to let my youth simply pass me by.” Even after Fire, he’ll have to budget frugally. CHF 3,000 a month isn’t much for a life in Switzerland. “But in 90 percent of countries, you can live comfortably on that.” He could imagine living in Asia or southern Europe.

This is what the financial expert says

Very few people embrace such a radical lifestyle as Parzy-Jagla’s; the Fire movement is a fringe phenomenon. Opinions on the subject are divided in the financial industry. “The concept is associated with considerable risks,” says Christian Gugger of VZ Vermögenszentrum Bern, for example . Depending on the circumstances, a return to work could be difficult, and the impact on retirement assets would be significant.

And: Anyone who wants to live off the returns from invested money is at the mercy of the fluctuations of the financial markets: “You have to be able to tolerate these uncertainties.” Nowadays, investments with higher risks are necessary, as safe investments hardly yield anything anymore due to the current interest rate situation.

Blogger and financial influencer Angela Mygind – known as Miss Finance – is also skeptical. She considers the movement’s goals extreme and difficult to implement in reality. “Anyone who wants to save so radically is quickly forced into social isolation.”

Nevertheless, many of the aspects it covers are interesting. Fire is a lifestyle that questions consumer society. Knowing how to live more frugally and invest wisely is beneficial for everyone. “Those who delve so deeply into their own finances can discover what’s truly important to them in life.”

How to become financially independent

However, there is controversy over how much one actually needs to save to be able to enjoy the desired retirement. The so-called 4 percent rule is considered a rule of thumb among Fire followers. It was introduced by American financial advisor William Bengen in 1994.

It states that the assets of a person who wants to retire early must be 25 times their annual expenses to achieve financial independence. “The calculation is based on investing your assets in such a way that you can withdraw 4 percent annually until the end of your life without affecting your capital,” explains Christian Gugger from the Wealth Center.

Both Gugger and Mygind have concerns: “Mathematically, this sounds good, but in practice, financial planning is much more complex,” says the expert. For example, the rule is not aligned with the Swiss franc and is subject to inflation.

For financial expert Christian Gugger, Fire is most likely to be implemented if a larger inheritance can be expected later or if the company continues to work on a small scale despite everything – this would then be a so-called Barista Fire.

Nicolas Parzy-Jagla will soon no longer need his lab coat. Whether he will turn his back on medicine for good remains uncertain.

Photo: Dominik Plüss

Nicolas Parzy-Jagla also doesn’t completely rule out returning to work at some point. After all, he does want children, and his passive income isn’t enough to support a whole family. He could imagine working a 20 percent job, for example. Perhaps he’ll even return to working as a doctor at some point. “Simply on my terms.”