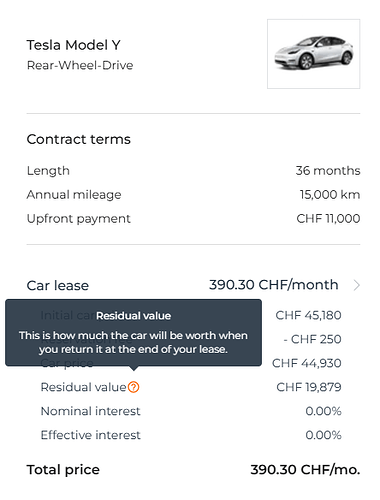

What does it define as residual value?

I thought a bit on legal ways to do this. The simplest one is that the contract is pure leasing, not leasing to buy. The car returns to leasing company/bank at the end of the contract. Then, this organization decides what to do with the car. The first option is to offer to sell at market value.

Probably none of the market value story is on the contract. All they need is “car is returned at the end of the lease, no option to buy”.

Potentially. If the contract has no defined option to buy at the defined residual price, then they might offer to sell under a separate contract at a price determined at the end of the lease.

I know its an unwritten rule that you can buy the car, so I did ask Gowago and they tried to assure me over the phone that of course I can.

Anyway lets see, the most obvious reason why they would want to take back the car is that you financed for 60,000 km and only did 20,000 km, so suddenly the car is worth a lot more than its calculated residual value.

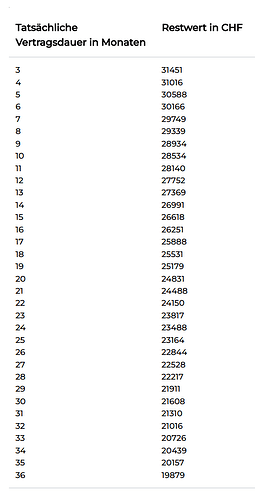

Here is my estimated residual value from 3-36 months old. Its a pure spreadsheet calculation unrelated to any real world data.

This is how they could do it but it would generate pretty bad publicity if enough people kicked up a fuss since its seems underhand.

Hi,

Many thanks for your reply. There is no mention for the buy out price in the contract but residual value is calculated for each specific month. The problem is that gowago and Tesla tell everyone that you can buy the car at residual value, which is clearly stated in the contract. However, the bank or gowago try to make money. As per Tesla, I am the first case unfortunately…

I tried to discuss this gowago but they told me that the offer from the bank is non-negotiable and if I don’t like it they can take back the car! As they are the owner of the contract, honestly I am not sure if I have further room to push the bank. I tried via Tesla sales guys but they got the exactly same answer. As frustrated and furious customer, I do expect Tesla help me here someway but I don’t know how.

I remember seeing in the news that others were stuck in the same situation but this was in the US. There, the lessee didn’t formally have any right to acquire the car and it was sold to someone else under larger deals as they got a good price due to the high prices due to covid shortages.

Due to higher inflation, it wouldn’t surprise me that car prices have risen and so the previously estimated residual values could be too low.

Are you under or over the allocated mileage?

I am trying to understand why they are doing this since it doesn’t make sense and loses them tons of goodwill. Its less hassle just to let you keep it for the agreed price, than them trying to dispose of it with all the fees that entails in an unpredictable market.

With my previous car I got sent a form towards the end of the lease asking me to state the mileage. So in this instance I would add 20k km and let them decide if they think its worth clawing back.

Yes its technically fraud but S.F.W.?

P.S They could of course ask you pay the excess mileage penalty and still give it back, in which case you could pardon the error and send them the correct mileage.

I am under the mileage so I am fulfilling everything as in my contract. This is so annoying that they are trying to make money on that and how I can trust either Tesla or gowago for potential leasing in the future… Will never again honestly.

I suspect if you look at the contract, there is no agreed price at which you have the right to acquire the car.

Presumably, with a Tesla, they can remotely read the odometer ![]()

Check your contract. Maybe they are also fulfilling everything in the contract too and have no obligation to sell you the car at the price. Now, if a sales rep made further representations to you that you could and these are evidenced, you might have a case.

Or maybe they will stick to the stated residual value if you push them enough?

Well, if you have evidence of what gowago said and your contract is with gowago, then you have a legal case.

I am not sure Tesla is to blame since they offered two choices ‘Gowago’ and ‘Leaseteq’ as their leasing partner. What might be worth a shot is getting a lawyer to write a letter stating that it was generally understood that you could buy the car for the agreed residual value. In my case I got somewhat of a verbal confirmation on the phone which I would be quick to reference.

I don’t recall giving Tesla permission to share this data with the bank. I know its technically their car but private information like my journey data should not be disclosed without my consent.

Maybe you don’t recall but could you have given permission when clicking through various long license agreements?

Why have a residual value on your contract if you cannot apply it, it is not there for decoration?

Maybe to give a non-binding indication of future value. Or provide information that help ‘close’ the lease deal by dangling the possibility of an attractive future acquisition price.

Not sure why it has to be so complicated. You can borrow a wedge of cash at an agreed interest rate which you pay for x years regardless of inflation or any other factors. So whether its a car or a trumpet shouldn’t matter since the bank pays Tesla their money and then you pay the bank the agreed interest rate.

This is from the Gowago.ch web site, not sure if it helps.

With every leasing contract a residual value is agreed upon.

So if your vehicle has a lower market value than the specified book value at the end of the contract period, you can return it without any worries and the dealer will bear the loss.

However, if the market value is higher than the residual value, you have the option to buy out the vehicle and resell it at market value.

You must therefore wait until the leasing contract has ended before you can request an offer to purchase the car at the end of your lease for the residual value.

Most leasing contracts do not guarantee you the exclusive right to buy.

The purchase price is calculated from the residual value and any fees that are due for the purchase.

That seems to have conflicting statements:

- With every leasing contract a residual value is agreed upon.

They talk about an agreed value

- The purchase price is calculated from the residual value and any fees that are due for the purchase.

But may be a get out with fees

- So if your vehicle has a lower market value than the specified book value at the end of the contract period, you can return it without any worries and the dealer will bear the loss.

Option to return without buying

- However, if the market value is higher than the residual value, you have the option to buy out the vehicle and resell it at market value.

Thye say you have the option to buy at residual value

- You must therefore wait until the leasing contract has ended before you can request an offer to purchase the car at the end of your lease for the residual value.

But you have to wait for an offer, which sounds like you don’t have the right to buy, only the lessor makes an offer

- Most leasing contracts do not guarantee you the exclusive right to buy.

Seems to confirm that you don’t have exclusive right to buy.